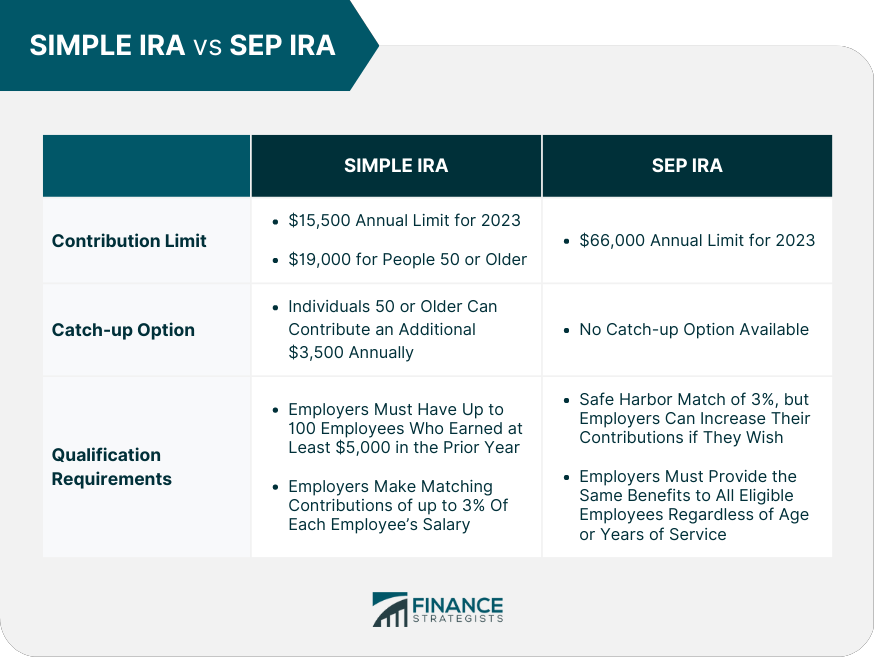

Simple Ira Contribution Limits 2025 Employer. However, because the simple ira plan limits your contributions to $16,000 in 2025 ($15,500 in 2025; The simple ira contribution limit for employees in 2025 is $16,000.

Contribution limits for simple ira plans are lower than other workplace retirement plans, such as a 401(k) plan. Here are the simple ira contribution limits to know.

Simple Ira Deduction Limits 2025 Lok Vere Allissa, The 2025 simple ira contribution limit for employees is $16,000.

401k Contributions Limits 2025 Betsy Charity, What are the contribution limits for a simple ira plan?

Simple Ira Employer Contribution Limits 2025 Arly Marcia, Workers age 50 or older can make additional.

Simple Ira Contribution Limits 2025 Employer Alanna Maryann, The contribution limit for a simple ira is $16,000 for 2025.

Simple Ira Contribution Limits 2025 Deadline Twyla Laurella, The simple ira contribution limit for employees in 2025 is $16,000.

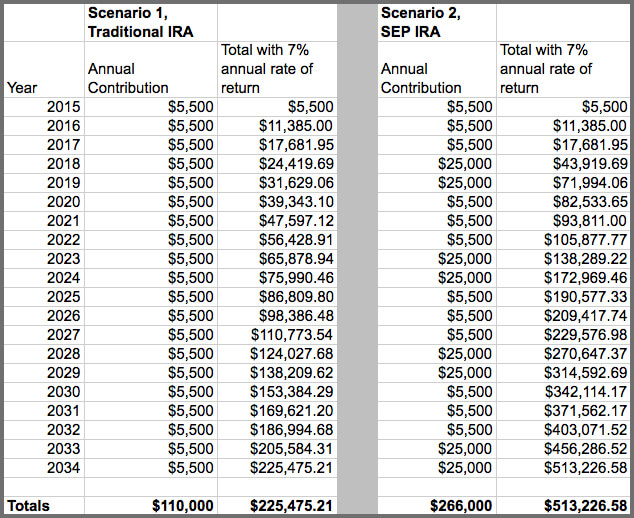

Sep Ira Contribution Limits 2025 Employer Perla Griselda, The ira contribution limits for 2025 are $7,000 for those under age 50, and $8,000 for those age 50 or older.

Simple Ira Contribution Limits 2025 Over 55 Dionne Constantia, As of 2025, for employers with 25 or fewer employees, employees are able to contribute up to 110% of the.

Simple Ira Contribution Limits 2025 Irs Eddi Margaretta, You can make 2025 ira contributions until the unextended federal.

Simple Ira Contribution Limits 2025 Deadline Twyla Laurella, Here are the simple ira contribution limits to know.

Sep Ira Contribution Limits 2025 Employer Perla Griselda, The 2025 simple ira contribution limit for employees is $16,000.